A Wild Ride on the Bitcoin Rollercoaster: Is MicroStrategy a Buy, Sell, or Hold in November 2025?

Folks, buckle up! If you've been watching MicroStrategy (MSTR) lately, you know it's been a rollercoaster. Down 40% in six months? That's enough to make any investor's stomach churn. But before you hit the eject button or dive headfirst into buying more, let's take a breath and look at the bigger picture.

Betting Big on Bitcoin: A Strategy Under Scrutiny

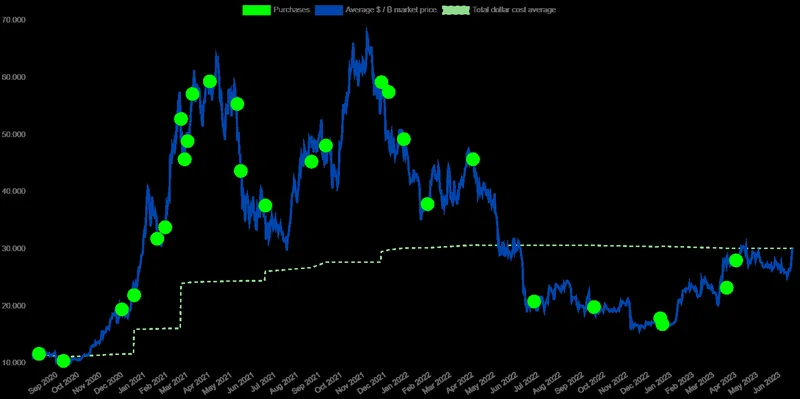

MicroStrategy, under the bold leadership of Michael Saylor, has essentially transformed itself into a Bitcoin holding company. They've amassed a staggering amount of BTC – we're talking about 641,692 Bitcoin. That's a lot of digital gold! But this strategy, once hailed as genius during the crypto boom, is now facing some serious scrutiny. Investors are questioning whether constantly buying more Bitcoin at these prices is a sustainable move. And honestly, it's a fair question.

I mean, imagine if Ford decided to put all its eggs into, say, lithium mining. It might pay off big, but it also introduces a whole new level of risk. That's kind of what MicroStrategy has done with Bitcoin. And with the company raising dividends on preferred shares to 10.5% to attract investors, and exploring options like Euro-denominated preferred shares, it feels like they're working overtime to keep the momentum going. But will it be enough?

The stock price has taken a beating, plummeting roughly 45% from its November peak. The premium investors once paid for MSTR shares over its Bitcoin holdings has shrunk dramatically. What was once 2.7x net asset value is now hovering around 1.06x. It’s like the market is saying, "Okay, we get it, you like Bitcoin, but is there anything else?"

And this is where it gets interesting. Strategy reported a net income of $2.8 billion in Q3 2025, tied to unrealized gains on their crypto stockpile, valued at $70 billion. That’s a massive number! But here’s the kicker: they added 487 Bitcoin using "just" $50 million from preferred stock sales. That’s a far cry from the multi-billion-dollar buying sprees that used to move markets. It suggests a more cautious approach, perhaps a sign they’re feeling the pressure. It makes you wonder, what will happen if Bitcoin dips further?

What does this all mean for you, the investor? Well, if you're bullish on Bitcoin, MSTR offers a way to gain exposure. Analysts seem to agree, with 12 out of 15 recommending a "Strong Buy." The average stock price target is around $523, indicating a potential upside of over 120% from current levels. But remember, this is a highly volatile play. MicroStrategy's fate is now inextricably linked to Bitcoin's performance.

But here’s the thing that really gets me thinking – is MicroStrategy just a proxy for Bitcoin at this point? Are investors buying into the company's software business, or are they simply using MSTR as a roundabout way to invest in crypto? And if it is just a Bitcoin proxy, is that a good thing, or does it create unnecessary risk and complexity? Strategy Shares Plunge as Bitcoin Retreats—More Pain Ahead?

Strategy's forward guidance is now heavily correlated with Bitcoin, relying on the cryptocurrency's performance. When the company reported Q3 earnings, its guidance incorporated a year-end price target for Bitcoin of $150,000. But that guidance may not be enough to persuade an investor to choose Strategy’s Bitcoin approach rather than directly investing in the digital asset or crypto spot price exchange-traded funds that provide exposure without share dilution.

The Future Belongs to the Bold

So, should you buy, sell, or hold? Honestly, it depends on your risk tolerance and your belief in Bitcoin. If you think Bitcoin is headed to the moon, MSTR could be a rocket ship. But if you're risk-averse, this might be one rollercoaster you want to avoid. For me, I see the boldness of Saylor's vision, but I also recognize the inherent risks. It's a gamble, no doubt, but sometimes the biggest rewards come from taking calculated risks. Just remember to do your homework and don't invest more than you can afford to lose. And as always, be sure to consult with a financial advisor before making any decisions!