MicroStrategy's Bitcoin Dip: A Chance to Snag the Future on the Cheap?

Okay, folks, buckle up, because we're diving into the wild world of crypto, specifically MicroStrategy (MSTR) and its recent tumble. You've probably seen the headlines: MSTR dipping below its net asset value (NAV), traders panicking about Bitcoin sales, and enough red arrows to make your head spin. But let's not get caught up in the short-term jitters, alright? Let's talk about the bigger picture—the real opportunity that's staring us right in the face.

See, sometimes the best deals are hidden in plain sight, disguised as "market corrections" or "investor uncertainty." It's like finding a vintage Ferrari covered in dust in someone's garage; everyone else sees junk, but you see the potential. And MicroStrategy right now? It's looking a lot like that Ferrari.

The Bitcoin Pendulum Swings

So, what’s going on? Well, Bitcoin (BTC) has been on a bit of a rollercoaster, right? Macroeconomic uncertainty is swirling, and that always makes the markets nervous. We saw MSTR stock dip below $200, pushing its market-to-NAV ratio down. Headlines scream "warning sign!" and "investor skepticism!" But hold on a second. Isn’t this exactly what creates opportunity?

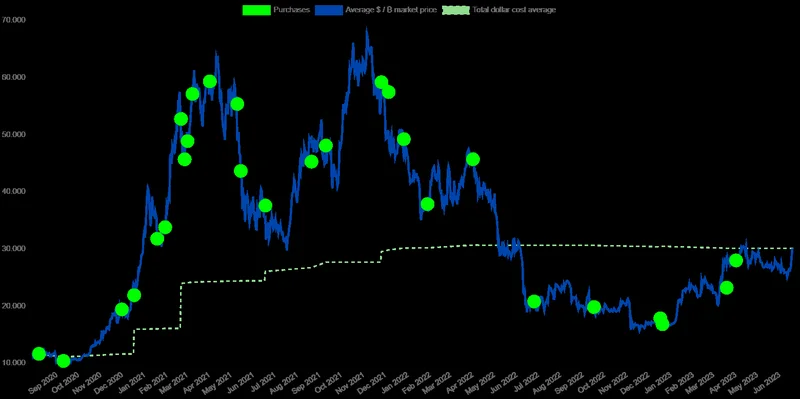

Michael Saylor, MicroStrategy's executive chairman, isn't sweating it. He's not just "hodling"—he's accelerating Bitcoin purchases during the dip. He sees this as a "temporary dislocation in a long-term secular trend." And honestly? I'm with him. Think about the internet in the late 90s. Remember all the naysayers? "It's a fad!" "It'll never last!" Now look where we are. Bitcoin, to me, feels like that same kind of foundational shift.

Here's where my excitement goes into overdrive: Saylor predicts Bitcoin hitting $150,000 by the end of the year. Now, I'm not one for blind faith, but his conviction—backed by MicroStrategy's actions—is a powerful signal. Wall Street analysts seem to agree, remaining positive on MSTR despite the recent turbulence.

Now, some traders are worried that MicroStrategy might be selling off its Bitcoin stash. Arkham Intelligence reported a dip in holdings, and MSTR stock was on track to hit a one-year low. But Saylor's response? A simple "HODL" posted on X, accompanied by an image of a burning ship. Talk about a visual statement. It suggests they're simply moving Bitcoin to new wallets, not cashing out. This reminds me of the early days of cloud computing, when companies were scrambling to build their own server farms, only to realize later that the cloud was a far more efficient solution. Are we seeing a similar transition in how Bitcoin is managed and secured?

And it's true, there's been chatter about Strategy moving a substantial amount of Bitcoin, sparking panic and speculation. But analysts are suggesting it's likely a custody restructuring, not a fire sale. It's like when a company reorganizes its departments—it doesn't mean they're going out of business; it means they're adapting and optimizing. MSTR Stock Falls 7% Pre-Market After Strategy Moves Over 47,000 BTC – But Michael Saylor Says ‘HODL’

But let's be real: Even if there were a partial liquidation down the line, one analyst pointed out that MicroStrategy is unlikely to be forced to sell Bitcoin as long as MSTR trades above $183.19 by 2027.

What does this mean for us? It means we have a chance to get in on the ground floor of something truly revolutionary. It's not just about Bitcoin; it's about the future of finance, the decentralization of power, and the potential for a more equitable world. But, of course, with any groundbreaking technology, there are ethical considerations. We must ensure that this future is inclusive and benefits everyone, not just a select few.

It's Time to Plant Your Flag

The market's knee-jerk reaction to any perceived bad news is creating a golden opportunity. MicroStrategy's dip isn't a sign of impending doom; it's a chance to snag a piece of the future at a discount. It's time to do your homework, weigh the risks, and consider whether this is the moment to plant your flag in the Bitcoin revolution.