The Mirage of More: 401(k) Hikes and Reality

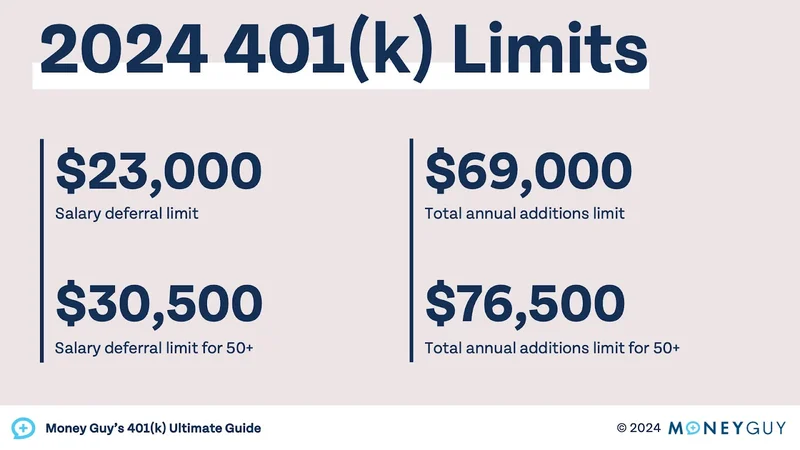

The IRS dropped its annual update on 401(k) contribution limits for 2026, raising the employee deferral cap to $24,500—a grand more than 2025’s $23,500. Catch-up contributions for those 50 and over also get a bump, hitting $8,000, up from $7,500. Secure 2.0 provisions let those aged 60-63 sock away an extra $11,250, unchanged from the previous year. All this dropped hours after Trump signed off on a funding bill, ending the shutdown. Timing is everything, I suppose.

The Devil in the Deferral Details

On the surface, it's all good news. More room to save is, theoretically, a win. But let's inject a dose of reality here. Vanguard’s 2025 “How America Saves” report states that only 14% of participants actually maxed out their 401(k)s in 2024. That’s based on a pretty hefty sample size—almost 5 million participants across 1,400 plans. So, while the IRS is patting itself on the back for giving us more headroom, the vast majority aren’t even close to hitting the existing ceiling.

The average combined savings rate, including employer contributions, hovered around 12% in 2024, according to the same Vanguard report. Fidelity, looking at a slightly different slice of the pie (24.6 million participants), pegged the average combined rate a bit higher, at 14.2% during the second quarter of 2025. Now, here's the critical question: Are these incremental increases in contribution limits actually moving the needle for the average saver, or are they primarily benefiting high-income earners who were already maxing out their accounts?

I’ve looked at hundreds of these retirement reports, and this persistent gap between the potential to save and the actual savings behavior is a recurring theme. It's like dangling a carrot that's always just out of reach for most people.

The Income Inequality Elephant

The IRS also rolled out 2026 IRA savings limits and income thresholds for Roth IRA contributions alongside this announcement. This is where things get a bit more nuanced. These adjustments, while seemingly minor, can have a real impact on tax planning strategies, particularly for those straddling income brackets. But let’s be honest, the average American isn’t sweating Roth IRA contribution strategies; they’re struggling to make rent and pay for groceries.

And this is the part of the announcement that I find genuinely puzzling. The agency releases dozens of inflation adjustments about a month prior, including federal income tax brackets and higher capital gains brackets. What's the real goal here? Is it to truly incentivize retirement savings across the board, or is it primarily a mechanism to manage tax revenue and cater to specific demographics?

The timing of the announcement, coming right after the end of a government shutdown, also raises eyebrows. Was this a calculated move to distract from the economic anxieties caused by the shutdown, or simply a routine administrative update? The data doesn’t tell us, but it is a question worth asking.