MP Materials: The Next Nvidia? Pump the Brakes.

MP Materials (MP), the rare-earth mining company, has been on a tear, up 250% this year. The comparison to Nvidia (NVDA), the AI chip behemoth, is seductive. Both, the narrative goes, control scarce resources crucial to modern tech. But let's dig into the numbers before we crown MP as the next trillion-dollar darling.

Scarcity Ain't Always Gold

The bull case hinges on scarcity. Nvidia's chips are scarce because of their superior design; MP's rare earths are scarce because the Mountain Pass mine is one of the few scaled sources outside China. The Trump administration even threw $400 million at MP, betting on U.S. independence from Chinese rare-earth imports.

Here’s where the analogy starts to crack. Nvidia's scarcity translates into massive pricing power and fat margins. MP? Not so much. Its gross margin is a staggering -2627.54%. Yes, that's a negative sign. It’s like saying you’re making money by selling dollar bills for fifty cents, except, you know, on an industrial scale.

Morgan Stanley, in a recent note, reiterated its "Equal-weight" rating, citing "project execution risks and rare earth price volatility." Translation: Lots can go wrong, and the price of what they dig out of the ground can swing wildly based on factors outside their control. (Unlike Nvidia, which largely dictates its own pricing.) The bank projects EBITDA of $22 million for 2025. A pittance compared to Nvidia’s billions. Is MP Materials stock worth owning amid rare earth volatility? MS weighs in By Investing.com

Magnets and Moonshots

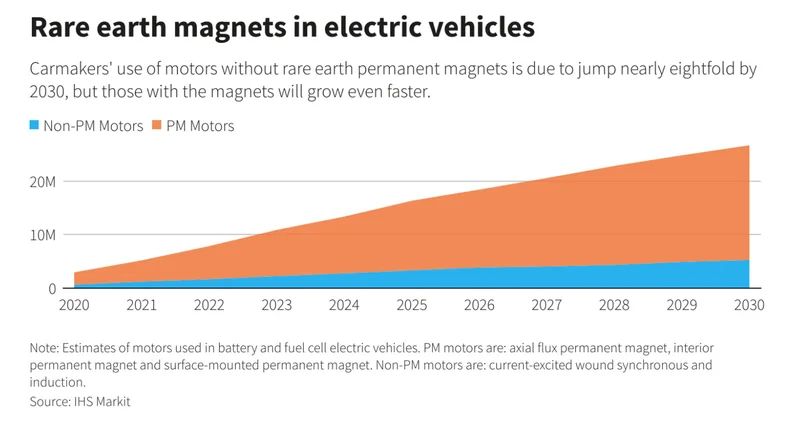

MP's plan is to become a fully integrated "mine-to-magnet" supplier, even partnering with the Department of Defense. By the end of 2025, they aim to commercially produce permanent magnets for EVs, wind turbines, and even… humanoids/robotics? (I’ve looked at hundreds of these filings, and that last one is unusual.)

Here's the rub: scaling magnet production is a huge execution risk. Building a mine is one thing; mastering advanced materials science is another. Even Morgan Stanley acknowledges that "project execution is the biggest risk now."

And what about that valuation? To match Nvidia's trillion-dollar market cap, MP would need to climb 44,900% from its current price. A 44,900% increase. Let that sink in. That's not just a moonshot; it's a trip to another galaxy.

MP is currently unprofitable. To justify its current valuation, the company needs not just growth, but explosive growth, and it needs to do so while navigating volatile commodity markets and complex manufacturing processes.

One more thing: the free cash flow. Nvidia is swimming in it. MP? Not so much. They're still building their second magnet factory (the "10X Facility"). The hope is that this facility will boost revenue and free cash flow. But hope is not a strategy, and it certainly isn't a substitute for actual cash.

The Recycling Wildcard

Morgan Stanley sees potential upside in recycling rare earths. This could "significantly boost MP's ability to expand its magnetics business." Maybe. But recycling is a notoriously difficult business, with its own set of technological and economic challenges. It's not a guaranteed win, and it's certainly not something to hang your entire investment thesis on.

MP's All Hype, No Substance

MP Materials has a compelling narrative, but the numbers don't back it up. The comparison to Nvidia is a stretch, and the execution risks are substantial. It's a classic case of a company trading on potential rather than actual results.