Bitcoin's "Dip" is a Rocket Ship Charging Up

Okay, friends, let's talk Bitcoin. I know, I know, the headlines are screaming "Bloodbath!" and "Freefall!" The Wall Street Journal is probably dusting off its "Bitcoin is Dead (Again)" template. But before you panic-sell your sats, let's take a breath and look at the bigger picture, shall we?

The Four-Year Cycle? More Like a Launch Sequence

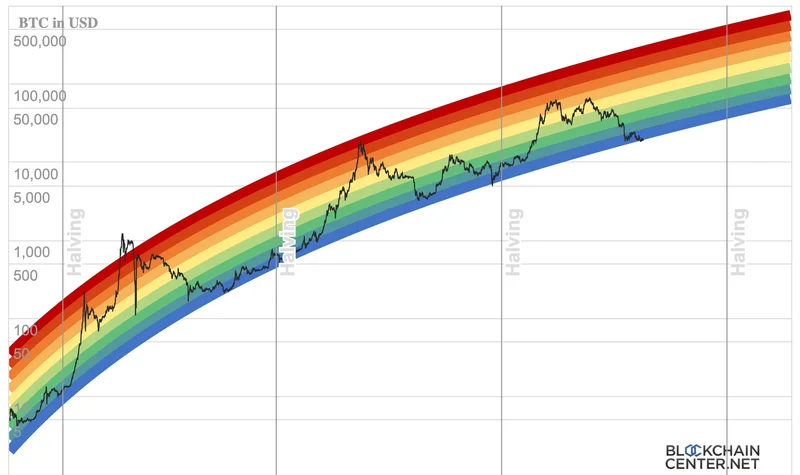

So, Bitcoin dipped below $93,200, wiping out its gains for the year? Cue the predictable chorus of doom-and-gloom merchants trotting out the "four-year halving cycle" theory. You know, the one that says Bitcoin booms after each halving, then crashes spectacularly? BTC/USD: Bitcoin Briefly Wipes Out All 2025 Gains as Prices Dip Under $93,200

Well, I've got news for you: Bitcoin's not some wind-up toy that follows a pre-programmed routine. This isn't your grandpa's market anymore. The game has changed.

Look, the halving does matter. It cuts the supply growth in half, which is inherently bullish. But to think it's the only driver is like saying the only thing that makes a rocket fly is the initial burst of the engines. What about the trajectory, the guidance systems, the sheer will to reach for the stars?

We've got Wall Street piling in with ETFs, bringing Bitcoin to grandma's retirement fund. We've got political winds shifting, with even the skeptics starting to see the light. And most importantly, we've got you, the believers, the innovators, the people who understand that Bitcoin is more than just a number on a screen. It's a revolution.

Now, I'm not saying there won't be turbulence. Of course there will be! Markets go up, markets go down. That's the nature of the beast. But this "dip"? I see it as a chance to refuel, to consolidate, to build a stronger foundation for the next leg up.

And let's talk about those "deep-pocketed buyers" who are supposedly "beating a retreat." Are they really running scared, or are they just playing the game? Buying low, selling high... it's as old as markets themselves.

What I find truly telling is how resilient the underlying infrastructure remains. As Jake Kennis at Nansen points out, Bitcoin is now embedded in institutional portfolios, responding to macro forces more than predictable supply shocks. In other words, it's growing up.

Now, I know some of you are probably thinking, "But Aris, what about the 'extreme fear' in the market? What about the traders betting on Bitcoin to crash to $80,000?"

To that, I say: Fear is a powerful motivator. It can drive people to make irrational decisions, sure. But it can also create opportunity. As Warren Buffett famously said, "Be fearful when others are greedy, and greedy when others are fearful."

And speaking of opportunities, let's not forget about Ethereum (ETH). It's taken a hit, sure, but it's still the backbone of the decentralized web. The potential here is still massive, and I'm incredibly excited about the innovation happening in this space. I mean, imagine a world where finance is open, transparent, and accessible to everyone. That's the promise of Ethereum, and it's a promise worth fighting for.

I saw one comment on Reddit that really resonated with me: "This isn't just about making money. It's about building a better future." That's what keeps me going, even when the charts look scary.

And that's why I'm still incredibly bullish on Bitcoin. Not because of some chart pattern or some pre-ordained cycle, but because of the underlying technology, the passionate community, and the sheer potential to change the world.

This Isn't a Crash, It's a Springboard

I'll be honest: when I saw Bitcoin briefly dip below that $93,200 mark, I had a moment of pause. But then I remembered why I got into this in the first place. It's not about the short-term fluctuations; it's about the long-term vision. Bitcoin isn't just an asset; it's a paradigm shift. And paradigm shifts don't happen overnight. It's time to buckle up, stay focused, and remember that the future is being built right now.